One of the most well-known property types, single-family homes are typically what the average investor thinks of in terms of accessible rental real estate. And for good reason: Since 2010, single-family rents have grown consistently by about 3%.

Their popularity and demand, as well as the reliability of cash flow and passive income, is what make single-family homes a perfect investment for long-term real estate investors. If you’re looking for diversification in your real estate portfolio, here’s why you should consider making them a part of your investment strategy.

What is a single-family rental property?

A single-family rental property, or SFR, is a type of rental property that is designed for one family to live in. This is typically a house or a townhouse. Single-family rentals are often found in suburban neighborhoods and are detached structures. They’ll frequently have a yard and a garage. In contrast, some other types of rental properties include:

- Multi-family homes: These are properties that have multiple families living under one roof. For example, duplexes, triplexes, and apartment buildings are considered to be multi-family housing because the property can be home to several families.

- Commercial properties: These include retail and industrial properties, such as warehouses, shops in mall complexes, and even data centers. Commercial real estate properties often have long-term leases, but with businesses, not individuals or families. Many of these are only available to institutional investors.

Historical investing returns on single-family homes

According to a 2020 report from the Joint Center for Housing Studies of Harvard University, renting has become more common among the age groups and family types that were once traditionally more likely to own a home. This is due to a combination of factors: rising home prices, higher lending rates, and a cultural preference for flexibility and freedom over putting down roots. This cultural change is more likely to be seen in the millennial generation. Accounting for roughly half of US households with children, these families are more likely to rent than own a home, research from Pew Center shows.

This higher demand for single-family homes may explain why, during the last 15 years, despite a recession, single-family rentals have continued to deliver an excellent return on investment through both appreciation and rental income. Since 2010 single-family rents have consistently increased by about 3% annually, and in Q3 2021 posted the fastest year-over-year increase in the last 16 years.

Why invest in single-family homes?

If you’re considering investing in real estate, single-family homes are worth looking into, especially in the current US real estate market. While managing single-family houses does require maintenance, upkeep, and repairs from the landlord, these are typically the easiest types of properties to manage. The leases tend to be long-term and the tenants are families who aren’t looking for a short-term residence. This translates as single-family rental homes having more consistent and reliable growth, with fewer overall expenses incurred on marketing the property, running background checks on tenants, and legal fees for contracts. Here are some aspects of single-family investments to consider and what makes them a good investment choice.

Undersupply of single-family homes

The United States housing supply is severely under-built and Freddie Mac estimates that the American housing market is undersupplied by 3.3 million units. This shortage is increasing by about 300,000 units a year, with not enough homes built to fill the demand.

And yet the demand, especially for single-family rentals, has been incredibly strong and it’s only growing. The US Census estimated that the number of single-family rentals in the US grew by 31% in the 10 years following the housing crisis of 2007.

Despite this, we’ve been building fewer homes than almost any time in US history. The factors are many. Labor and materials costs have doubled since the peak of the mid-2000s housing boom and the National Association of Home Builders estimates that regulatory costs increased the cost of a new home by 30% from 2011 to 2016.

The undersupply and consistent demand of single-family rentals is what makes them such a steady and reliable investment. The demand ensures consistent rental value and appreciation, while low supply ensures higher liquidity in comparison with other investment properties.

Low volatility

Compared to the stock market, real estate in general and single-family rentals in particular, are a lot less volatile. Over the past 25 years, single-family rental returns were nearly identical to returns from stocks and even outperformed bonds, according to one study. Researchers compared single-family rental housing returns data from the US Census Bureau, as well as S&P 500 returns data and 10-year Treasury returns data from 1992 to 2017. They found that compared to the stock market, single-family rentals were a lot less volatile.

At its high point during this 25-year span, S&P 500 stocks posted average annual returns in excess of 35 percent, but returns also plummeted equally during their worst year, the study reported. Alternatively, single-family rental investments posted 17.5 percent returns during their best year, and only declined 2.5 percent in their worst year. The stock market had 6 down years during this period compared to 2 years for the single-family rental sector.

It’s also important to note that while inflation has been rising in the US, the median sales price of houses up until now has been increasing at a rate faster than inflation, making it even more stable and less risky as an investment.

Multiple ways to profit

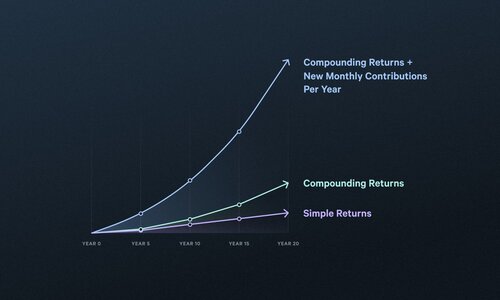

What makes single-family homes such a good opportunity and investment comes down to the leverage they afford to the average investor. With only a 20% deposit and a mortgage for the remaining 80%, you can purchase a residential property, rent it out, and start seeing returns immediately.

What’s better, because the rent is coming every month, depending on the market prices and demand, you may be able to use a large portion of that rent to pay off the mortgage. What this effectively means is that with a small lump sum of 20%, you’ve been able to fund an entire property with very little money of your own.

The rent pays off a large part of your mortgage, but to sweeten the deal even more, as house prices go up, you benefit from the appreciation as well. All the while getting incredible tax advantages, better interest rates, and a solid, reliable rate of returns.

With residential rental properties, it’s also possible to force appreciation, and therefore rent prices, by investing in upgrades and renovating the property. This is often a way used by investors and homeowners to increase the value of the property and get an even bigger return on their investment.

Strong demand and appreciation

According to data from a Freddie Mac survey, 45% of renters want to move into a single-family home for their next rental. A primary driving factor for this is the size of a home versus an apartment. Over 65% of rental homes have at least 3 bedrooms compared to only 11% of apartments. (Side note: All our homes on Arrived have at least three bedrooms). Rental homes also benefit from higher appreciation rates compared to other properties such as condos, multi-family rentals, commercial properties, and industrial real estate.

Also keep in mind that single-family homes tend to have lower tenant turnover, which means that tenants are typically on a one- or two-year lease. This saves you money in expensive marketing and legal costs for finding, verifying, and bringing in new tenants frequently – not to mention the time spent. It also limits the number of weeks or months that your property might sit vacant as you find new tenants, and therefore lose rental income in the meantime. The average single-family residential tenant tends to stay in a property for three years, which is double the average apartment tenure. It is not uncommon for families to stay in these homes for five to six years or more.

Easy financing

What makes buying a single-family home far easier than other investment properties – for example, multi-family properties – is the access to easy financing. With just a down payment, you can purchase a full property and reap the rewards of the entire investment, even paying off a portion of the mortgage loan with rent payments allowing you to use leverage through borrowed money to increase returns.

Single-family residence rentals are powerful income generators, but they’re also one of the most secure investments you’ll find. And that’s why it is easier to get mortgages on these types of properties from banks and mortgage lenders. Multifamily properties are considered businesses in the eyes of a lender and so they underwrite it from a cash flow perspective – that is, the income it generates and its financial performance. This is largely not the case with single-family homes, even when it’s being bought as a rental property and you’re applying for a non-owner occupied loan.

Down payments on single-family properties also tend to be lower. With a conventional loan, you typically need to put 20% down as opposed to 25 to 30% down for more commercial properties.

Flexible investing

Buying a property outright is not the only way to invest in single-family homes. In fact, with technologies like Arrived, you can not only become a property owner in multiple places and take advantage of hotter rental markets such as San Francisco and New York, but you can do so without the need to worry about maintenance or management of the home.

Fractional ownership in real estate is a way of buying a portion or percentage of a property, with each property divided up into several parts or fractions. These parts are then made available for purchase to multiple co-owners, each with fractional interest, allowing them to share in both the cost and the rent.

Fractional owners also profit from the appreciation of the property, which can be a lot higher in more expensive markets. Fractional properties are usually maintained by third-party property management companies that are paid proportionally by the co-owners.

When it comes to single-family rental properties, investing as a fractional real estate owner allows you to take advantage of properties in multiple cities and neighborhoods as well as larger properties with higher rents that you may not have been financially accessible as a single investor. Our investments at Arrived are structured as REITs (Real Estate Investment Trusts), which gives you certain tax advantages as well.

Investing in single-family homes vs. multi-family homes

When it comes to residential real estate investing, most investors will want to think about single-family vs. multi-family properties. Multi-family properties are typically five units and above, though this could mean fifty or five hundred units or more. While it is easier to scale faster with multi-family units, here are some reasons why single-family homes are a better investment:

- Easier financing: As mentioned above, when banks and mortgage lenders look at multi-family investments, they judge them on different factors than they do single-family dwellings. For a multi-family property, banks will want to not only qualify you, but the property itself—its income generation potential, the market valuation of the property, and whether that income can service the debt.

- Higher occupancy: Single-family residential units have low vacancy rates, especially compared with multi-family properties. This makes managing them far simpler, not to mention inexpensive. There is also a lower tenant turnover in single-family homes.

- Higher liquidity: What makes buying a single-family home easy and attractive is also what makes selling a single-family home easy. With high demand, low availability, lower barrier to entry, and ease of financing, a single-family home is considerably more liquid than other forms of rental real estate.

Easily invest in rental homes

For all the reasons mentioned above, single-family homes are a fantastic real estate investment with low barriers to entry and easy access to financing. Given the high demand and low tenant turnover, you’re likely to have an easy-to-maintain property that provides year-on-year returns for a considerably lower investment than commercial or other property asset classes.

At Arrived, our mission is to give investors opportunities to take advantage of property appreciation and rental income without any of the hassle of finding and maintaining a property. Through our model of fractional real estate investing you can take advantage of higher rental values in the hottest markets and reap the cash flow and appreciation benefits. Look through the properties available on Arrived to get started or add more properties to your portfolio.